Every year is a blessing if you find opportunities. The interest rate was very low during the pandemic. Gradually to cool off inflation the Fed started raising interest rates. People who bought homes with loans over $700k at a 2% interest rate pay $14k in interest. Comparably, in August 2023 borrowing $200k at 7% you have to pay $14K in interest.

Since the pandemic, the stock market is a roller coaster ride. If you have amassed a huge sum of money in the pandemic kudos to you. However, news outlets keep reporting recession may or may not come. I have been preparing and contributing to cash equivalent in 401k accounts. The cash equivalent is not growing since it’s not invested in equity(stocks). The cash can be utilized well or can be reinvested when the market crash to grow money faster and catch up. Although, no one can predict a stock market crash unless you’re a warren buffet and pull all your money out.

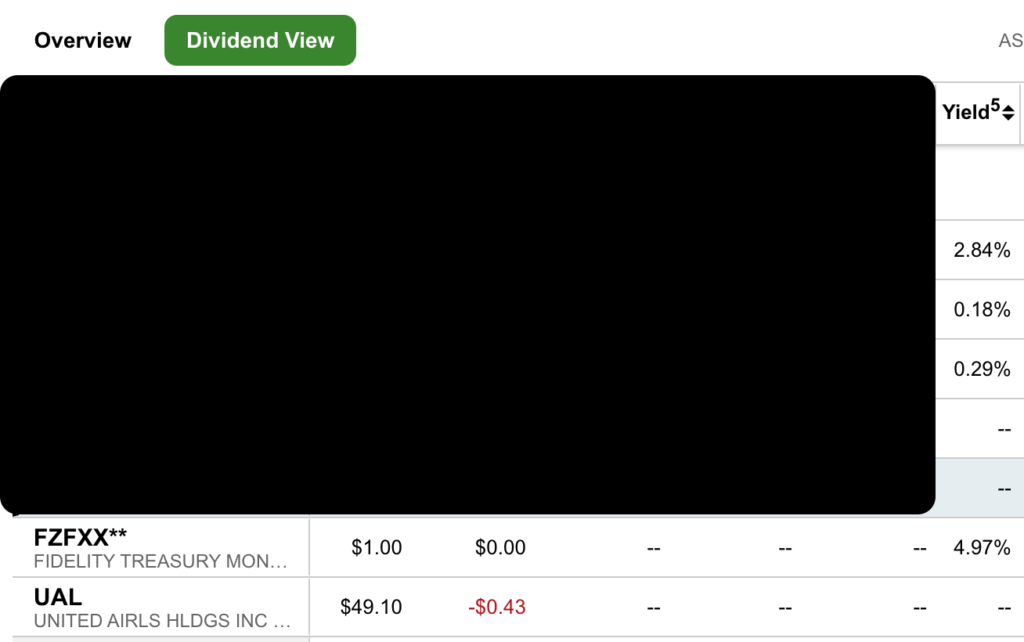

Brokerage Account – Money Market Fund interest 4.97%

I have a brokerage account with Fidelity. I keep cash in the account. The cash is invested in a money market fund, it pays a dividend of 4.97%. There are two takeaways from the personal finance book called “Rich Dad, Poor Dad” by Robert Kiyosaki

- Make money work for you

- Pay yourself first

When I receive a paycheck, I pay myself first. The money goes straight to the Fidelity account. As I mention, it makes 5% interest on cash kept in the account. It pays monthly, so the money is compounded monthly instead of yearly or 6 months on contrary to CD. In addition, your money is locked for a set period of time in a CD account.

401k Account interest – 8.5%

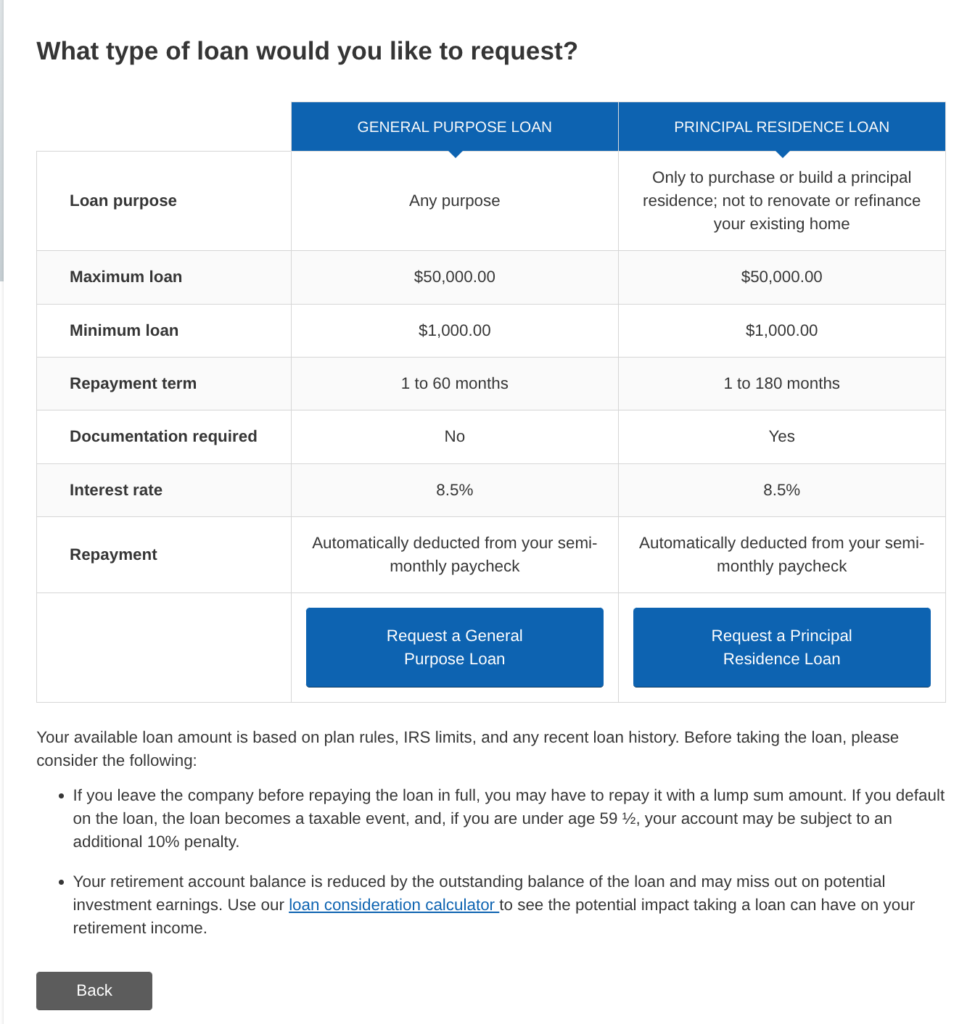

There are two types of loans you can take from 401k, GENERAL PURPOSE LOAN and PRINCIPAL RESIDENCE LOAN. The general purpose is used for a short period of time and can be used for buying assets like a car. Whereas the principal residence loan can be used for buying assets like your primary residence home and has a longer repayment term (180 months). Both the loans have same interest rate. The latter requires more paperwork and I personally prefer less hassle so I will opt for a general-purpose loan. In addition, I am not eligible for Principal Residence Loan as I am not buying a home. The sole purpose of this loan is to make more money safely.

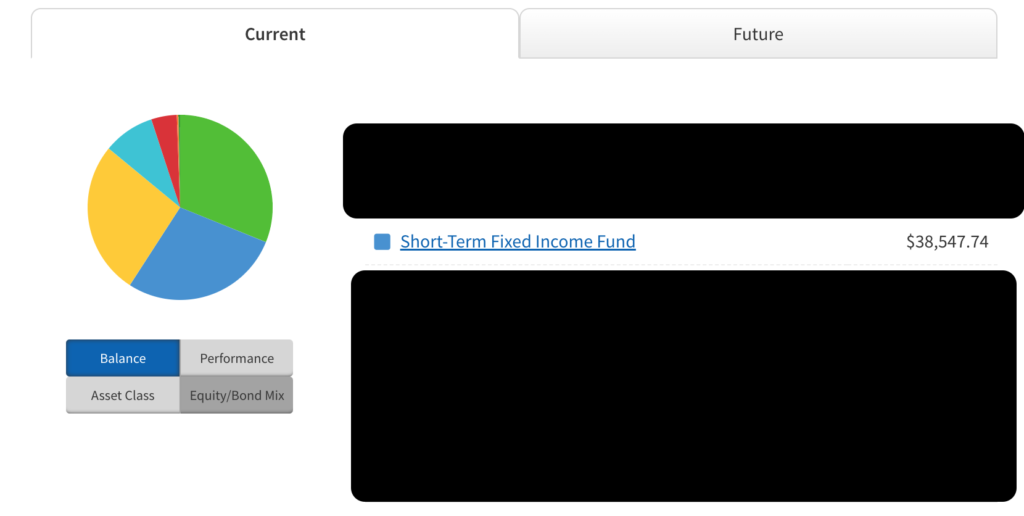

Due to the market turmoil, I have been investing in cash equivalent on my 401k account. I have accumulated around $38k. It’s not growing, now it’s time to take a loan and earn 5% interest by simply keeping it in a brokerage account. I am taking a loan against the cash equivalent therefore, I am not missing out on an opportunity

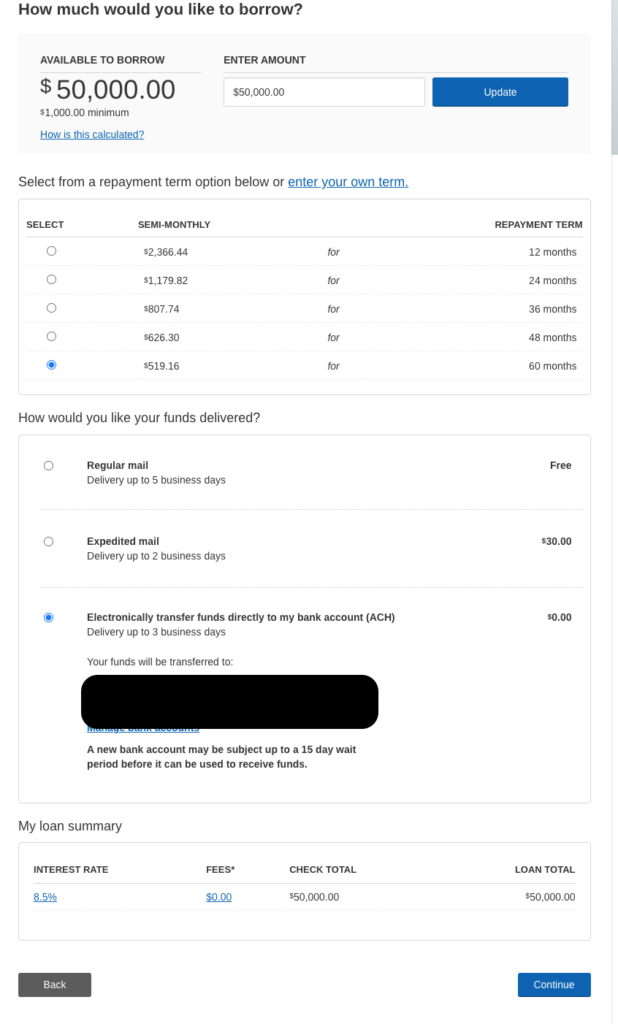

More details about the loan payment structure can be found below

Conclusion

Combining both accounts you can earn 13.5% in interest on your investment. My contingency plan is to take the loan and keep cash in the brokerage account. If I were to leave the company I will pay it off and repeat the process since there are no fees for taking a loan from a 401k account. Hope you found this information helpful to grow your money. Write us in the comment below

Pros

- No fees

- Pay interest to yourself instead of the bank

- The loan does not impact a credit score

- Contribute more to 401k account than IRS contribution limit (2023 limit $22,500)

- Auto payment to loan from paycheck (post-tax money)

Cons

- If you leave the company before repaying the loan in full, you may have to repay it with a lump sum amount

- If you default on the loan, the loan becomes a taxable event, and, if you are under age 59 ½, your account may be subject to an additional 10% penalty.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment. We are not affiliated with or make an endorsement of any of the companies mentioned in this article