The easiest way to create an income is by investing in the stock market. Stock market has thousands of stocks listed and it can be daunting to find a good one where you don’t lose money. Loss and Gains are a part of the financial journey that will give you invaluable knowledge.

Step 1: List Your Expenses

Here is a list of my monthly expenses. I may not have all the expenses listed. Some of the expenses I manage actively to reduce monthly costs like wifi bills, and car insurance by switching the providers

| Description | Amount |

| Mobile Bill (Family 3 lines) | $84 |

| Car Insurance | $66.66 |

| Wifi | $75 |

| Pseg | $25 |

| Cooking Gas | $12 |

| Gas (commute) | $130 |

| Health Insurance (family member) | $10.81 |

| Gym | $14.12 |

| Monthly Learning | $20 |

| Groceries | $300 |

| Misc | $100 |

| Total | $837.59 |

Step 2: Create an Income Equals to Each Expense

There are many ways to create a passive income. The approach I choose is to invest in the stock market. I picked the REIT sector stocks to create consistent monthly income. I have also invested in other high-yield dividend-paying stocks. These stocks are categorized as Qualified dividends. Qualified dividends must meet special requirements issued by the IRS. The maximum tax rate for qualified dividends is 20%, with a few exceptions for real estate, art, or small business stock. On the contrary, the ordinary dividend is taxed as earned income ( similar to how salary is taxed )

These are a few high-yield dividend stocks I have invested in.

The capital was raised using the strategy I write in this blog post

| Stock Ticker | Dividend Yield |

| AGNC | 14.53% |

| NLY | 13.11% |

| ARR | 18.79% |

| EFC | 13.52% |

| MPW | 11.66% |

| RC | 4.96% |

| VZ | 8% |

| T | 7.93% |

| AM | 7.67% |

There are safer options to generate income without losing a penny. Borrow money as described in the article, the link can be found above the table. Invest money in a CD (Certificate of Deposit). Since the market rates are skyrocketing, CDs pay over 5% APY (Annual percentage yield). APY in other words is interest paid to you on your principal amount. In Addition, brokerage accounts have money market funds where you keep cash and get paid in dividends. Fidelity account pays monthly and it compounds month on month

Loss Proof Investments

- Invest in CDs that pay over 5% (note: create a CD ladder for greater return)

- Keep the cash in MMA (Money Market Account – Fidelity MMA pays 4.96% as of August 7th, 2023)

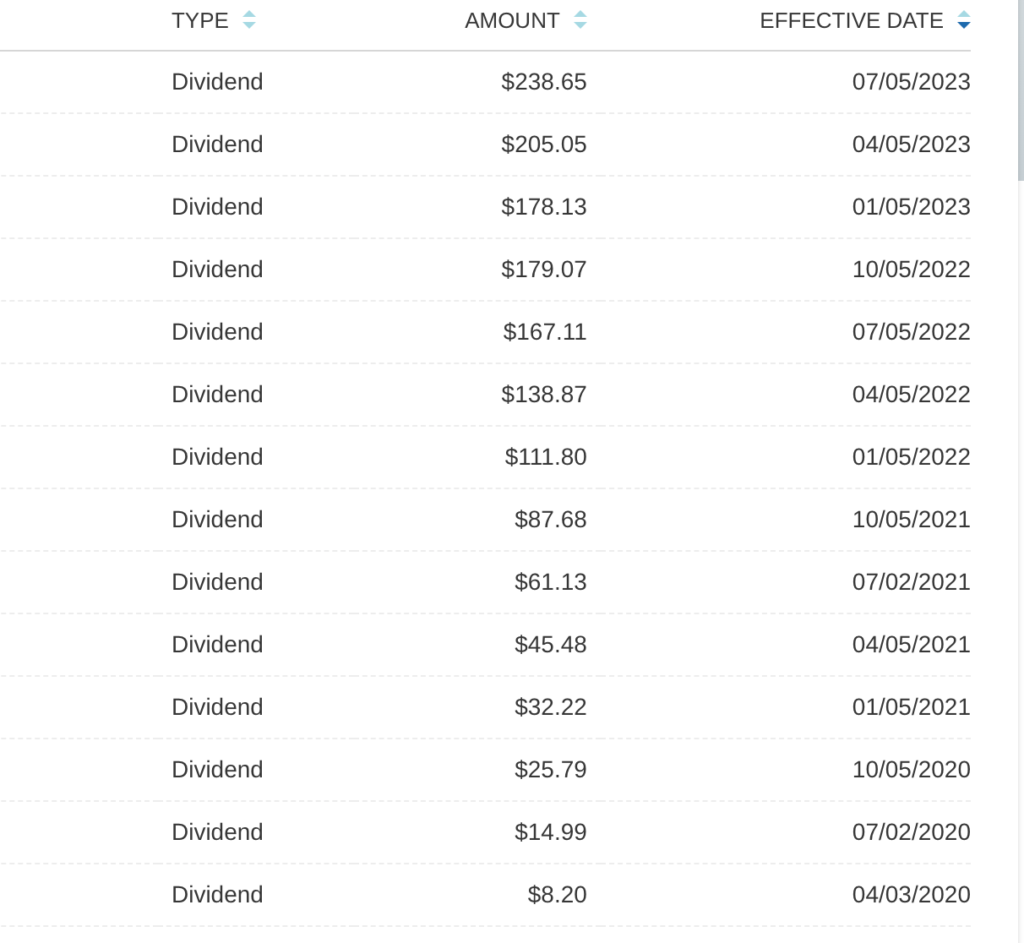

BONUS: Invest in a 401k fund that pays dividends. You can cash out dividends from your 401k account. I have been doing it for a long time now.

Start of dividend journey today. Be consistent and disciplined. The screenshot below is from my 401k dividend account

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.