The Federal Reserve has been continuously raising key interest in 2023. Buying a new car or taking a mortgage loan is more expensive compared to the pandemic time when the interest rates were significantly low. However, there are two proven strategies we can apply to get the loan with up to 50% cheaper interest rate. Balance transfer from credit card and Be Your Own Bank (BYOB)

1. Balance transfer from Credit Card

According to the survey Americans carry 4 credit cards on average. Having more credit cards in your household is a blessing. In spite of having many credit cards, we use 1 or 2 credit cards on daily purchases. The rest of the credit cards are sitting in our houses and the credit amount allocated to a credit card is unused. Since the money is unused, the banks would like us to use it. The banks come up with balance transfer offers. Before accepting the offer, It should be carefully evaluated. Furthermore, you must devise a plan to pay it off before the period ends to avoid the highest interest rate charged on your credit card.

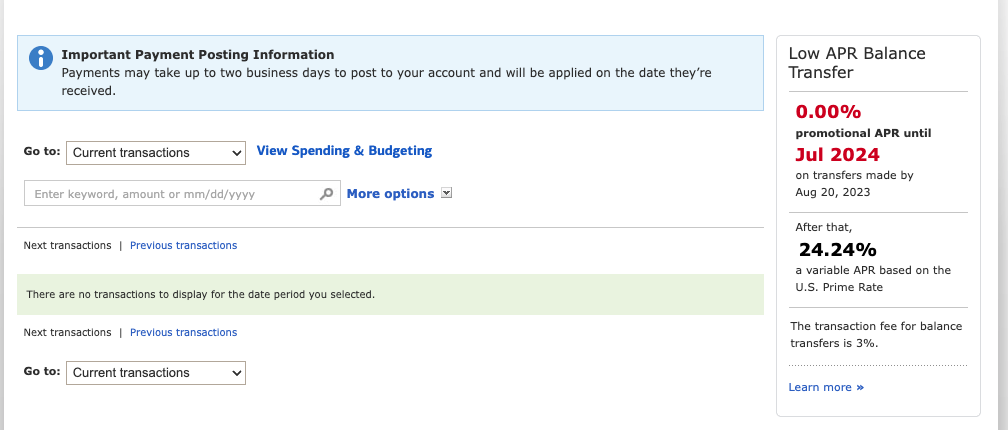

The screenshot below is taken from my credit card account. The offer is displayed on the left side with highlighted keywords of the offer. This screenshot was taken on August 4th, 2023.

Let’s evaluate the offer:

- 0% Interest rate for 12 months

- 3% fees will be charged

If you take this offer you will be charged a 3% fee on the amount you’re withdrawing as a balance transfer from your credit card. For example, if you have a credit card with a $10,000 limit and you’d like to withdraw the full amount. You will receive $9,700 and $300 fees will be charged. There are two ways balance transfer pays to you in cash and direct payment to your high-interest credit card. I prefer cash.

I personally prefer to accept a balance transfer offer that has 0% interest rates for 18 months and 3% fees. I have used the balance transfer offers many times through various credit cards like Discover and Bank of America. Both of these companies paid the balance transfer in the form of cash to my checking account. However, you must do due diligence before accepting the offer and have the plan to pay off before the period end this is key and I keep repeating it

The money can be used to pay off the high-interest debt, consolidate payments, move your debt to a different card, or invest (stocks, bonds).

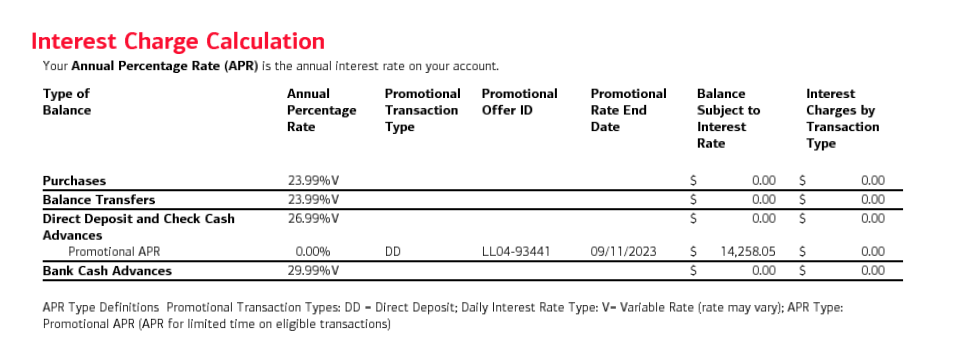

How I used the money from the balance transfer

The offer I accepted was a 3% interest rate for 18 months period. I used the balance transfer cash to invest in stocks. The income I generated over 18 months is far more compared to what I paid in fees. Furthermore, the income generated is a qualified dividend and falls under the lower income tax bracket. The offer period will be ending on September 11th, 2023. To avoid the high interest I will be paying off the full amount and I already scheduled the payments from brokerage to checking account and payment to credit card. The outstanding balance on my credit card is approximately $14,000 and I have the same cash amount sitting in my brokerage account. The brokerage account is paying me 4.97% of the cash money sitting in my account as of today. The interest is paid monthly so it’s compounding every month. Therefore, I am making more money from my investment than the fees I paid. Below is a screenshot from my credit card statement

Offer

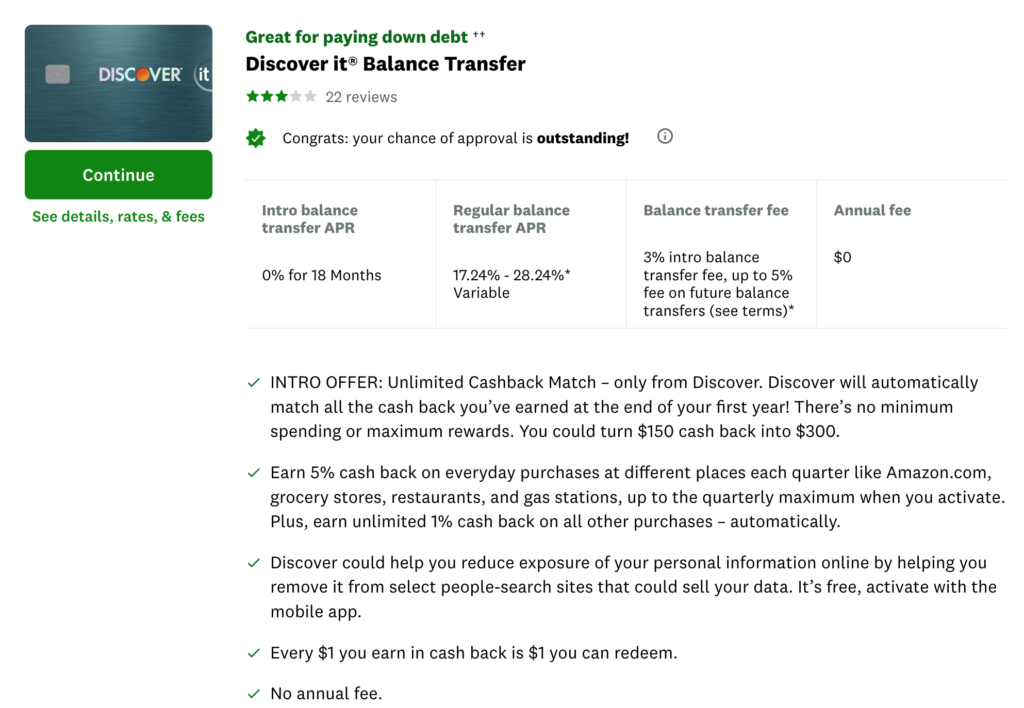

I found the credit card which offers 3% fees and 18 months to pay back. I will for sure apply for this credit card soon

Pros

- Low-interest rate

- Up to 18 months to pay back

- Pay off high-interest debt

Cons

- You’re obligated to pay minimum monthly payments (Varies from provider)

- Pay the full amount before the end of the offering period to avoid high interest on the outstanding balance

- Very high interest after the offering period ends

Tips

- Pay off the full amount before the end of the offering period

- Schedule minimum auto payments to avoid additional fees

2. BYOB: Be Your Own Bank

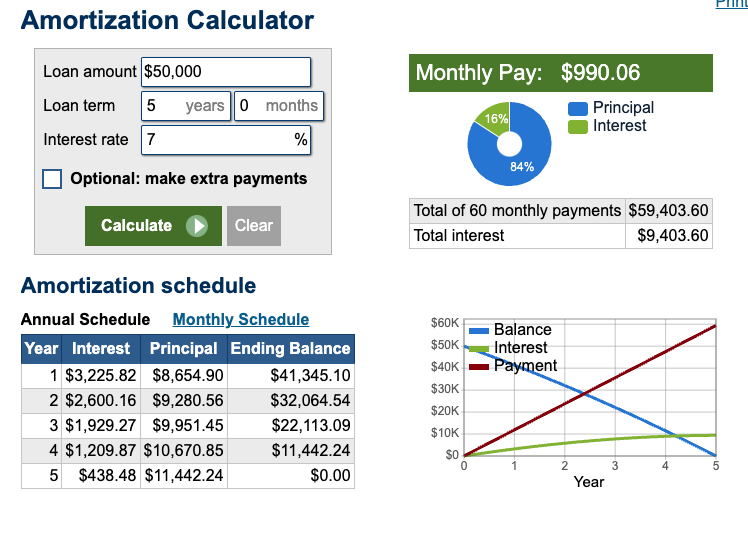

When we borrow money from banks we pay them interest. Considering rate hikes in 2023, banks are offering loans with over 7% interest rates. Using the amortization calculator here is the breakdown of how much we are going to pay in interest only for borrowing $50K at a 7% interest rate for 5 years. We will be paying $9,403.60 interest at the end of 5 years.

Let’s Be Our Own Bank

BYOB means you borrow money from yourself and pay interest to yourself. To qualify for this opportunity you must have investments that allow you to borrow against your investment. Many white-collar jobs offer 401k. The money you have in your 401k account can be qualified as BYOB. However, 401k is not the only investment vehicle that qualifies as BYOB, the other investment is life insurance policy. If you have a life insurance you could qualify for BYOB. These are the two I am aware of. Other investments could qualify, I would suggest you reached out to the provider for more information

Now let’s say I am interested in purchasing a brand new tesla model Y which costs approximately $50K. The traditional way of purchasing a car is through a bank loan. As I mentioned in the example above, it would cost us $9,403.60 in interest. However, If we borrow from our own investments like 401k, we will be paying principal + interest to ourselves. How cool is that?

Knowing this information about becoming your own bank, I will always borrow (Take a loan, DO NOT WITHDRAW) money against my own investment to grow my personal wealth.

Generating wealth requires strategy, planning, and discipline. If I don’t have enough money in my 401k account and I am anticipating a major purchase down the line. The action plan is to start contributing to a 401k cash equivalent fund (why? just because I don’t want uncertainties of the market by investing in stock/index funds) and maximize contribution so I can borrow at a future date. The IRS has a limit of $22,500 a year for 2023 contributions.

The loan from a 401k account can be taken for any amount you’re eligible for. The eligible loan amount can be calculated by the 401k provider along with the interest rate. However, you’ll never get 100% of your investment as a loan. If you have an outstanding loan with high interest, I would suggest taking a new loan from a 401k account and paying it off

Pros

- Can borrow up to 2 loans (Varies by the provider

- You don’t have to pay taxes and penalties when you take a 401(k) loan

- The interest you pay on the loan goes back into your retirement plan account

- If you miss a payment or default on your loan from a 401(k), it won’t impact your credit score because defaulted loans are not reported to credit bureaus

Cons

- If you leave your current job, you might have to repay your loan in full in a very short time frame

- if you can’t repay the loan for any reason, it’s considered defaulted, and you’ll owe both taxes and a 10% penalty if you’re under 59½

Tips: If you decide a 401(k) loan is right for you, here are some helpful

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Disclaimer: This is not an investment advice. We are not affiliated with any of the financial firms mentioned in this article nor we are promoting them.